VCM Alpha Vee

Workstation Case Study

Simplifying Complexity: Alpha Vee Workstation Powers Virtue Capital Management’s Innovative Strategy Research and Selection Platform

Virtue Capital Management (VCM) is an independent Registered Investment Adviser (RIA) platform that provides advisors with a wide range of advisory solutions, portfolio management resources, and technology, back-office and compliance support for both fee-only and hybrid advisors.Investment advisers and asset managers that want to bring new strategies and products to market often face a daunting challenge: Developing efficient processes for testing their investment ideas and gathering the historical fundamental and pricing data needed to run this analysis.

VCM’s Turnkey Asset Management Platform (TAMP) offers advisors access to more than a hundred portfolio models ranging from those offered by leading institutional managers to innovative boutique strategists.

With so many choices available, advisors often told VCM that it was challenging for them to evaluate and select investment strategies that aligned with their clients’ investment objectives and risk tolerance.

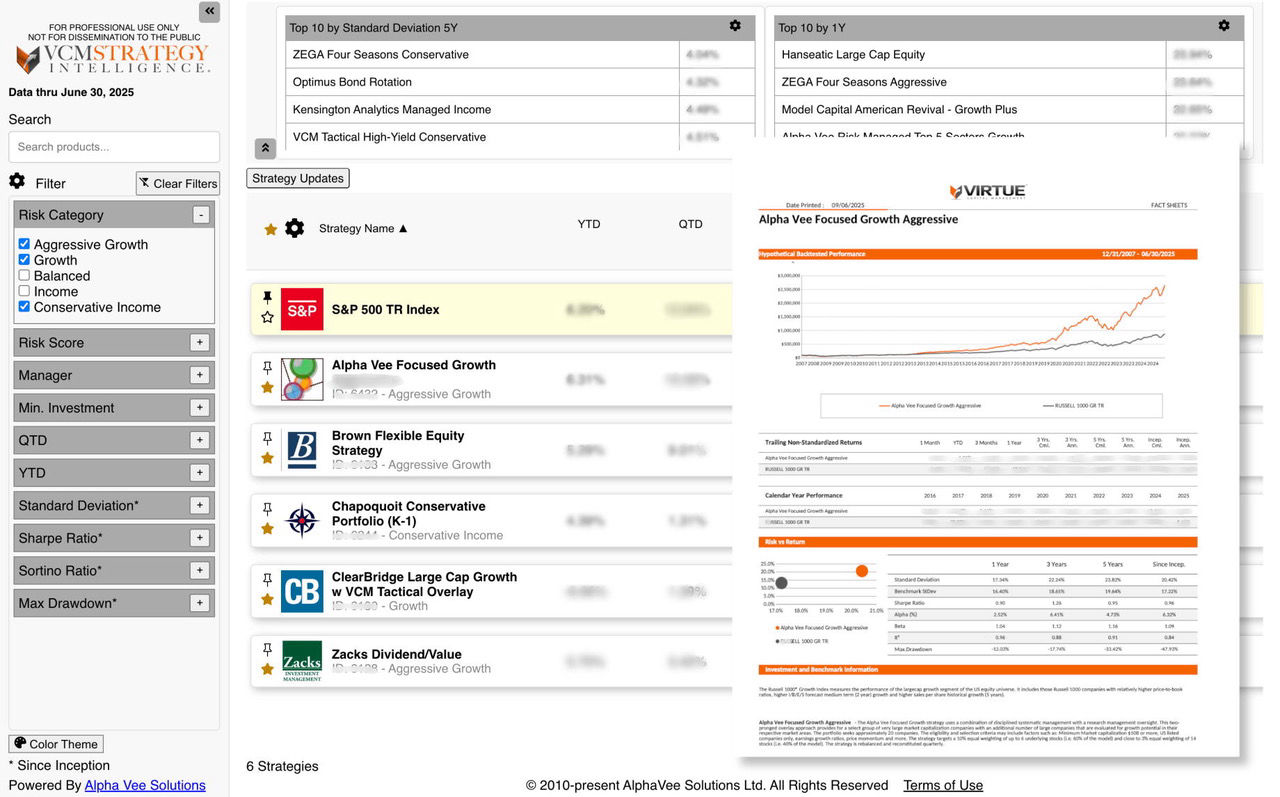

To simplify this process, VCM decided to build a proprietary strategy research tool, VCM Strategy Intelligence, powered by the Alpha Vee Workstation.

VCM Strategy Intelligence allows advisors to instantly:• narrow down strategies based on a client’s specific goals and risk profile;• generate branded fact sheets for the selected strategies; and• construct dynamic portfolio blends that advisors can compare to a client’s existing portfolio and benchmarks.

“The real value of the Alpha Vee Workstation modules lies in its ability to deliver powerful data and insights with exceptional speed and usability. Having a platform that enables our advisors to analyze over 100 investment strategies, identify best-in-class solutions, and generate professional-grade fact sheets in just a few clicks has been a significant enhancement to our technology ecosystem,” says VCM CEO Jeremy Rettich.

A Natural Evolution of an Established Relationship

VCM already had a long-standing, mutually beneficial relationship with Alpha Vee. It began when VCM initially chose several of Alpha Vee’s flagship Top 5 Sector strategies for its TAMP platform.

Over time, the two companies evolved that relationship into co-developing customized strategies tailored to meet the needs of VCM-affiliated advisors and their clients.

So, when VCM envisioned creating what would ultimately become VCM Strategy Intelligence, Alpha Vee Workstation was one of several platforms they were considering that offered similar analytical and portfolio construction tools.

“What set Alpha Vee Workstation apart was its unique combination of customization flexibility, sophisticated end-client reporting, competitive pricing and unmatched service--a combination that aligned perfectly with our needs and those of our advisor network,” says Rettich.

In particular, Alpha Vee’s willingness to tailor the Alpha Vee Workstation’s tools and outputs to VCM’s platform's structure and branding was a major differentiator.

The end result?

“The integrated Alpha Vee Workstation/VCM Strategy Intelligence platform transforms what could be a time-intensive evaluation process into an efficient, client-facing experience, allowing advisors to focus more on delivering value and less on managing data,” says Rettich.

“Alpha Vee didn’t just deliver a solution--they provided a partnership. This collaboration has exceeded our expectations, and we’re extremely pleased with the value and responsiveness they bring to the relationship.”

Whether you’re building, testing and validating your own models and investment ideas or are looking for ways to make it easier for advisors or wholesalers to evaluate, select and present your portfolio recommendations, Alpha Vee Workstation can help you lower legacy terminal costs, streamline and simplify these time-consuming, data-driven tasks.

About

Integrated software & Investment strategies for professionals. Spend more time finding ideas that generate alpha.

Terms Of Use and Risk DisclosuresDisclosure: Investing contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.